( NOTE: Want to take your financial leadership to the next level? Download the 7 Habits of Highly Effective CFO’s. It walks you through steps to accelerate your career in becoming a leader in your company.

- The difference between marginal costing and absorption costing is a little complicated. In Marginal Costing, Product related costs will include only variable cost while in case of Absorption costing, fixed cost is also included in product related cost apart from variable cost.

- Variable vs Absorption Costing Problems Osawa, Inc., planned and actually manufactured 200,000 units of its single product in 2004, its first year of operation. Variable manufacturing costs was $20 per unit produced. Variable operating cost was $10 per unit Variable vs. Absorption Costing Problems sold.

) Absorption Cost Per Unit Because is a “per-unit” method, it is necessary to understand how to determine the absorption cost per unit. So the fair question remains: What is the absorption cost approach? Ultimately, all of the calculations are done on a Per-Unit basis.

Variable Costing Versus Absorption Costing System: Under absorption costing system, all costs of production (both variable and fixed) are treated as product costs. The unit product cost consists of direct materials, direct labor and both variable and fixed overhead.

For example, Wintax Company creates 5,000 products with per unit being $60 direct materials, $110 direct, and $40 variable. In addition to the per-unit costs, the fixed is $100,000. In order to obtain the cost under, first the per-unit costs are added together (, variable ). After that, per-unit costs need to be obtained from the fixed so that the per-unit can be applied to the per-unit cost.

Adding the to the per-unit costs completes what is absorption per unit. See how to work out the problem below.

Solution Per-Unit Costs Fixed- per-unit (direct labor + direct materials +variable overhead) + (fixed / number of units) ($210) + ($20) Absorption cost per unit: $230 Absorption Cost Unit Pricing In addition to determining the overall cost of a singular, absorption gives one the ability to determine the appropriate selling of a unit as well. As long as there is a target, the absorption method can calculate the appropriate.

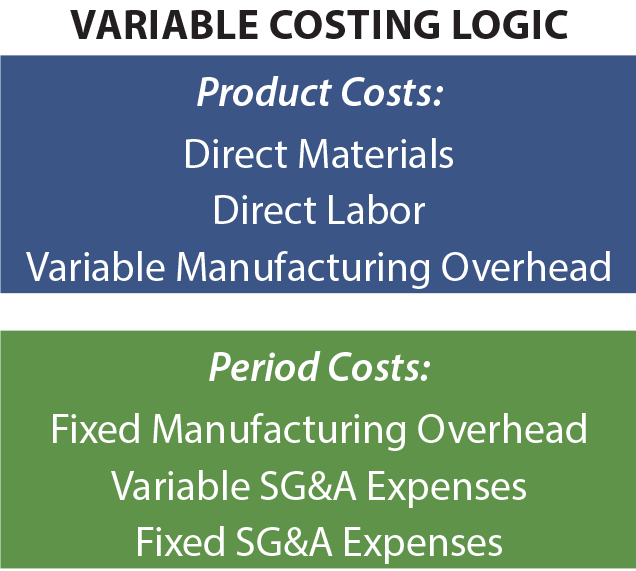

Variable Costing

For example, Bizzo Company desires a of $180,000 while producing 10,000. In addition, each costs $150 to produce in total.

In order to determine the appropriate selling, first, divide by the number of. Add that number to the original product cost in order to achieve the correct product.

Check out the solution worked out below. Soution ((Desired ) / (Number of Units)) + ( Cost Per-Unit) ( $180,000 / 10,000 ) + ( $150 ) Target Price= $168 Absorption Costing Formulas (Absorption Cost per-unit) = (Per-Unit ) + (Per-Unit Fixed ) Sales = ( Per-Unit) + (Sales and Per-Unit) + (Profit Markup) Deciding whether to be competitive in or maintain status in the market is one of the many key a has to make.

Download the free to find out how you can become a more valuable financial leader.

Absorption costing, also called full costing, is what you are used to under Generally Accepted Accounting Principles. Under absorption costing, companies treat all manufacturing costs, including both fixed and variable manufacturing costs, as product costs. Remember, total variable costs change proportionately with changes in total activity, while fixed costs do not change as activity levels change. These variable manufacturing costs are usually made up of direct materials, variable manufacturing overhead, and direct labor. The product costs (or cost of goods sold) would include direct materials, direct labor and overhead.

The period costs would include selling, general and administrative costs. The following diagram explains the cost flow for product and period costs. The product cost, under absorption costing, would be calculated as: Direct Materials + Direct Labor + Variable Overhead + Fixed Overhead = Total Product Cost You can calculate a cost per unit by taking the total product costs / total units PRODUCED. Yes, you will calculate a fixed overhead cost per unit as well even though we know fixed costs do not change in total but they do change per unit. We will assign a cost per unit for accounting reasons.

Variable Costing Advantages And Disadvantages

When we prepare the income statement, we will use the multi-step income statement format. We will not get as complicated in our multi-step income statement as the video example but it should have provided a refresher from what you should have learning in financial accounting. For our purpose, the absorption income statement will contain: Sales – Cost of Goods Sold = Gross Profit Operating Expenses: Selling Expenses + General and Admin. Expenses = Total Expenses = Net Operating Income Gross Profit is also referred to as gross margin.

Variable Costing Vs Absorption Costing

Net operating income is Gross Profit – Total Operating Expenses and is also called Income before taxes.